What is ESG?

ESG is an acronym that stands for Environmental, Social, and Governance and it is a framework that helps stakeholders understand how an organization is managing risks and opportunities related to Environmental, Social, and Governance criteria (sometimes called ESG factors). ESG takes the holistic view that sustainability extends beyond just environmental issues.

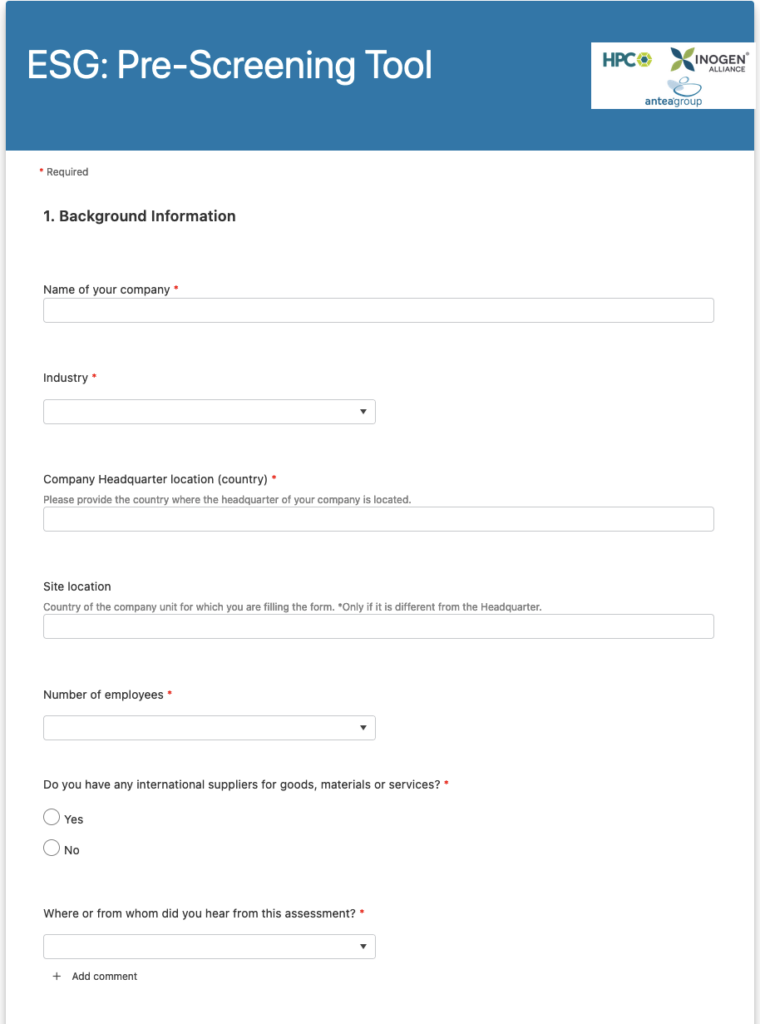

Free ESG Self-Assessment Tool

Inogen Alliance is excited to announce a new first to market ESG self-assessment digital survey tool to assess ESG progress or test the maturity of an organizations sustainability initiatives. Our free detailed global ESG Pre-Screening tool is the first of it’s kind to help companies develop formal and comprehensive systems to manage ESG or sustainability-related risks and take advantage of potential opportunities.

Read the full article here.

Environmental factors refer to an organization’s environmental impact(s) and risk management practices. These include direct and indirect greenhouse gas emissions, management’s stewardship over natural resources, and the firm’s overall resiliency against physical climate risks (like climate change, flooding, and fires).

The Social pillar refers to an organization’s relationships with stakeholders. Examples of factors that a firm may be measured against include human capital management (HCM) metrics (like fair wages and employee engagement) but also an organization’s impact on the communities in which it operates. A hallmark of ESG is how social impact expectations have extended outside the walls of the company and to supply chain partners, particularly those in developing economies where environmental and labor standards may be less robust.

Corporate Governance refers to how an organization is led and managed. ESG analysts will seek to understand better how leadership’s incentives are aligned with stakeholder expectations, how shareholder rights are viewed and honored, and what types of internal controls exist to promote transparency and accountability on the part of leadership.

While the term ESG is often used in the context of investing, stakeholders include not just the investment community but also customers, suppliers, and employees, all of whom are increasingly interested in how sustainable an organization’s operations are.

Actually, ESG has evolved from other historical movements that focused on health and safety issues, pollution reduction, and corporate philanthropy.

ESG has changed how capital allocation decisions are made by many of the largest financial services firms and asset managers in the world.

An emerging class of ESG specialists is stepping into the industry and supporting both net zero and carbon neutrality goals.

Baden Consulting proudly co-sponsored the Global Summit on ESG Reporting for the Energy & Extractive Industries on June 20, 2023 in Brussels, Belgium together with its Inogen Alliance partners Antea Group Belgium, Ayrton Group, denxpert, HPC Germany and HPC Italy

The Evolution of ESG

The ESG lens helps assess how an organization manages the risks and opportunities created by changing conditions, such as shifts in environmental, economic, and social systems.

Some of these conditions were identified in earlier versions of sustainability-focused strategic and/or regulatory frameworks, including:

- EHS

- Corporate Sustainability

- CSR

- SLO

- ESG

EHS (Environment, Health and Safety)

As far back as the 1980s, organizations in the United States were considering how to use regulation to manage or reduce pollution (and other negative externalities) produced in the pursuit of economic growth. They sought to also improve employee labor and safety standards, although much progress remains to be made even today.

Corporate Sustainability

EHS evolved in the 1990s into what was then known as the Corporate Sustainability movement. This emerged as some management teams wanted to focus on reducing their firm’s environmental impacts beyond the reductions that had been legally mandated.

It’s widely agreed that corporate sustainability was often employed by management teams as a marketing tool to overstate (or otherwise misrepresent) efforts and environmental impacts — a practice that would later become known as greenwashing.

CSR (Corporate Social Responsibility)

By the early 2000s, the corporate sustainability movement began to integrate ideas around how companies should respond to social issues. This would become known as Corporate Social Responsibility.

Corporate philanthropy was a key component of CSR, although some critics argue that tax incentives made cash donations as attractive as their ultimate economic impact on recipients. Employee volunteerism was another hallmark of CSR.

SLO (Social License to Operate)

Scholars generally date the first published use of the phrase to 1996, when it was invoked by W. Henson Moore, President of the American Forest and Paper Association, to explain the pro-active environmental policies of American paper industries. Moore argued that the industry’s independently verified environmental achievements could persuade the public that the industry merited their trust, allowing them to enjoy what he coined as a ‘Social License to Operate’. Holding this license would allow the industry to avoid the ‘dark side’ of what might happen when communities chose to revoke their acceptance of the industry’s practices.

The Social License to Operate (SLO), or simply social license, refers to the ongoing acceptance of a company or industry’s standard business practices and operating procedures by its employees, stakeholders, and the general public.

SLO is created and maintained slowly over time as a company builds trust with the community it operates in and other stakeholders.

In order to protect and build social license, companies are encouraged to first do the right thing and then be seen doing the right thing.

ESG (Environmental, Social and Governance)

Though the term “ESG” made its first mainstream appearance in a 2004 UN report, it was not until the late 2010s and into the 2020s that ESG emerged as a much more proactive (instead of reactive) movement.

ESG has now evolved into a comprehensive framework that includes key elements around environmental and social impact, as well as how governance structures can be amended to maximize stakeholder well-being.

Corporate Sustainability Reporting

European Union

EU rules require large companies and listed companies to publish regular reports on the social and environmental risks they face, and on how their activities impact people and the environment.

What the EU is Doing and Why?

EU law requires all large companies and all listed companies (except listed micro-enterprises) to disclose information on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment.

This helps investors, civil society organizations, consumers and other stakeholders to evaluate the sustainability performance of companies, as part of the European green deal.

The Corporate Sustainability Reporting Directive (CSRD)

On 5 January 2023, the Corporate Sustainability Reporting Directive (CSRD) entered into force. This new directive modernizes and strengthens the rules concerning the social and environmental information that companies have to report. A broader set of large companies, as well as listed SMEs, will now be required to report on sustainability – approximately 50 000 companies in total.

The new rules will ensure that investors and other stakeholders have access to the information they need to assess investment risks arising from climate change and other sustainability issues. They will also create a culture of transparency about the impact of companies on people and the environment. Finally, reporting costs will be reduced for companies over the medium to long term by harmonizing the information to be provided.

The first companies will have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025.

Companies subject to the CSRD will have to report according to European Sustainability Reporting Standards (ESRS). The draft standards are developed by the EFRAG, previously known as the European Financial Reporting Advisory Group, an independent body bringing together various different stakeholders. The standards will be tailored to EU policies, while building on and contributing to international standardization initiatives.

On 6 June the Commission opened a four-week public feedback period on a first set of sustainability reporting standards for companies. These draft standards take account of technical advice from EFRAG in November 2022.

Following the feedback period, the Commission will consider the feedback received before finalizing the standards as delegated acts and submitting them to the European Parliament and Council for scrutiny.

The CSRD also makes it mandatory for companies to have an audit of the sustainability information that they report. In addition, it provides for the digitalization of sustainability information.

Rules Introduced by the Non-Financial Reporting Directive

The rules introduced by the Non-Financial Reporting Directive (NFRD) remain in force until companies have to apply the new rules of the CSRD. Under the NFRD, large companies have to publish information related to:

- environmental matters

- social matters and treatment of employees

- respect for human rights

- anti-corruption and bribery

- diversity on company boards (in terms of age, gender, educational and professional background)

These reporting rules apply to large public-interest companies with more than 500 employees. This covers approximately 11,700 large companies and groups across the EU, including:

- listed companies

- banks

- insurance companies

- other companies designated by national authorities as public-interest entities

Switzerland

Environmental Social Governance (ESG) reporting is mandatory through the Swiss Non-Financial Reporting requirement. Mandatory non-financial reporting was passed into law in 2022, with the first report due in 2024 for the year 2023. The report must follow the criteria defined in the Swiss Code of Obligations, Articles 964a-964l. If companies use other national, European or International standards for reporting, the report must state this, and the company must ensure that all Swiss requirements for non-financial reporting are met.

Who is Required to Report?

Companies that fulfill all of the following criteria:

- Publicly traded companies. Meaning a company that is listed on a stock exchange, has outstanding bonds, and/or contribute at least 20 % of its assets or turnover to the consolidated accounts in terms of stock or bonds. It is a company that is subject to the financial market supervision (financial reporting).

- A Swiss company and its foreign undertakings having more than 500 full-time employees in 2 successive financial years.

- A Swiss company and its foreign undertaking together exceed at least one of the following amounts in two successive financial years: A balance sheet total of 20 million francs, and/or sales revenue of 40 million francs.

Note: these requirements do not apply to companies that are required to prepare an equivalent report under foreign law.

What Topics Does the Report Cover?

Environmental matters, especially the CO2 goal of the company, what it is currently and how it will be achieved.

Social matters such as employee-related issues, human rights at work and in the supply chain, and combating corruption.

Special topics to report on are as follows:

Supply Chain: Transparency in Raw Materials

A Swiss company or a company it controls must report payments made to state bodies for extraction of minerals, oil, natural gas or/and harvesting of timber in primary forests. The report shall detail the amount of payment and the reason for payment. The Swiss authorities may also require companies trading in raw materials to submit such a report.

Due Diligence: Minerals and Metals from Conflict-Affected Areas and Child Labor

To combat child labor and promote human rights, the Swiss legislation requires a supply chain due diligence management system. Companies are ones having in their supply chain the following activities: placing or processing in Switzerland minerals containing tin, tantalum, tungsten, gold, or metals from conflict-affected or high-risk areas. Also, companies that may have child labor in their supply chain. The due diligence management system shall trace the supply chain and conduct a risk management plan. The risk management plan will include risk identification and risk minimization or elimination. Compliance audits by a third-party specialist shall be conducted as part of the due diligence management system requirements.

Where Should the Report be Published and When?

On the company website after 6 months from the end of the financial year. The report shall be publicly available for 10 years.

Our ESG Advisory Services

Environmental, Social and Governance (ESG) is quickly emerging as the leading business strategy to evaluate the overall health of a business’s operating model and the company’s long-term resiliency. Stakeholders are increasingly investigating and, in some cases, demanding, thoughtful, forward-looking policies and programs that incorporate environmental and social impacts and how they are governed. At Baden Consulting, our consultants have the strategic thinking and technical expertise to provide client-specific advisory that helps clients navigate, understand, and proactively manage their ESG risks and opportunities to embed a programmatic approach that lasts. We provide our clients with a clear framework on setting up Key Performance Indicators (KPI), monitoring and sustaining their programs. Our consultants help set up CSR, ESG and SLO programs. Our approach is holistic, examining financial, social and environmental aspects of our clients. We establish a tailored program that helps our client reach their goals (CSR, ESG or SLO goal).

ESG Reporting Support

We can help you compile your ESG Report, both based on European Union CSRD requirements or on Swiss Non-Financial Reporting requirements. Please contact us for a consultation.

References

- Environmental and Sustainability Management Consulting (2023). Baden Consulting. Retrieved from https://www.badenconsulting.com/services/environmental-and-sustainability-management-consulting/

- ESG Advisory Services (2023). Antea Group US. Retrieved from https://us.anteagroup.com/services/esg-advisory-services

- ESG (Environmental, Social, & Governance) (2023). Corporate Finance Institute. Retrieved from https://corporatefinanceinstitute.com/resources/esg/esg-environmental-social-governance/

- Kenton, W. (2021). Social License to Operate (SLO): Definition and Standards. Retrieved from https://www.investopedia.com/terms/s/social-license-slo.asp

- Understanding the Social License to Operate (2021). Law Futures Centre. Retrieved from https://blogs.griffith.edu.au/law-futures-centre/2021/08/03/understanding-the-social-licence-to-operate/

- Corporate sustainability reporting (2023). European Commission. Finance. Retrieved from https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en